Do you want to learn more about debit, credit entries, and how to record your journal entries properly? Then, head over to our guide on journalizing transactions, with definitions and examples for business. Thus, the income summary temporarily holds only revenue and expense balances. Remember that all revenue, sales, income, and gain accounts are closed in this entry.

Monthly Financial Reporting Template for CFOs

A closing entry is a journal entry made at the end of an accounting period. It involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet. These accounts must be closed at the end of the accounting year. Your business will need to transfer the balances into the income summary account to close these revenue and expense accounts. The income summary account is another temporary account, only used at the end of an accounting period.

Movement on the Retained Earnings Account

To close that, we debit Service Revenue for the full amount and credit Income Summary for the same. When you manage your accounting books by hand, you are responsible for a lot of nitty-gritty details. One of your responsibilities is creating closing entries at the end of each accounting period. Companies are required to close their books at the end of eachfiscal year so that they can prepare their annual financialstatements and tax returns.

- Therefore, these accounts still have a balance in the new year, because they are not closed, and the balances are carried forward from December 31 to January 1 to start the new annual accounting period.

- To make them zero we want to decrease the balance or do the opposite.

- Then, transfer the balance of the income summary account to the retained earnings account.

- The net income (NI) is moved into retained earnings on the balance sheet as part of the closing entry process.

How to post closing entries?

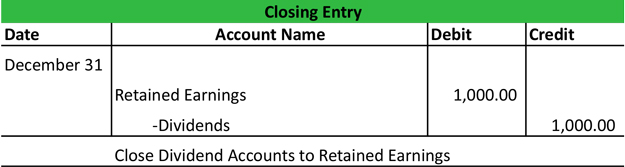

The closing entry will credit Dividends and debit Retained Earnings. The accounts that need to start with a clean or $0 balance going into the next accounting period are revenue, income, and any dividends from January 2019. To determine the income (profit or loss) from the month of January, the store needs to close the income statement information from January 2019. We see from the adjusted trial balance that our revenue account has a credit balance. To make the balance zero, debit the revenue account and credit the Income Summary account.

Step #2: Close Expense Accounts

Closing entries are journal entries used to empty temporary accounts at the end of a reporting period and transfer their balances into permanent accounts. Temporary accounts are used to accumulate income statement activity during a reporting period. The use of closing entries resets the temporary accounts to begin accumulating new transactions in the next period.

Balance Sheet

Creating closing entries is one of the last steps of the accounting cycle. This is no different from what will happen to a company at the end of an accounting period. A company will see its revenue and expense accounts set back to zero, but its assets and liabilities will maintain a balance. Stockholders’ equity accounts will also maintain their balances. In summary, the accountant resets the temporary accounts to zero by transferring the balances to permanent accounts.

Notice that the balances in the expense accounts are now zero and are ready to accumulate expenses in the next period. The Income Summary account has a new credit balance of $4,665, which is the difference between revenues and expenses (Figure 5.5). The balance in Income Summary is the same figure as what is reported on Printing Plus’s Income Statement. Other accounting software, such as Oracle’s PeopleSoft™, post closing entries to a special accounting period that keeps them separate from all of the other entries.

Permanent (real) accounts are accounts that transfer balances to the next period and include balance sheet accounts, such as assets, liabilities, and stockholders’ equity. These accounts will not be set back to zero at the beginning of the next period; they will keep their balances. The next day, January 1, 2019, you get ready for work, but before you go to the office, you decide to review your financials for 2019. What are your total expenses for rent, electricity, cable and internet, gas, and food for the current year?

In short, we can clear all temporary accounts to retained earnings with a single closing entry. By debiting the revenue account and crediting the dividend and expense accounts, the balance of $3,450,000 is credited to retained earnings. The retained earnings account balance has now increased to 8,000, and forms part of the trial balance after the create and send an online invoice for free have been made. This trial balance gives the opening balances for the next accounting period, and contains only balance sheet accounts including the new balance on the retained earnings account as shown below. Having a zero balance in theseaccounts is important so a company can compare performance acrossperiods, particularly with income.

As you will learn in Corporation Accounting, there are three components to thedeclaration and payment of dividends. The first part is the date ofdeclaration, which creates the obligation or liability to pay thedividend. The second part is the date of record that determines whoreceives the dividends, and the third part is the date of payment,which is the date that payments are made. Printing Plus has $100 ofdividends with a debit balance on the adjusted trial balance. Theclosing entry will credit Dividends and debit RetainedEarnings. To close revenue accounts, you first transfer their balances to the income summary account.