So, let’s get started with these budgeting worksheets for high school students. Finance 101 is a financial simulation game that uses decisions to teach finances. The player is assigned a random profession and has a total of 13 steps until the game is over.

Credit Clash

It’s simple but a terrific way to introduce a discussion on spending, saving, and budgeting. This online game feels a bit like a graphic novel, and it helps kids learn the basics of budgeting and money management. Explore multiple topics and complete missions to learn valuable skills. When you invest your money in an interest-bearing account, it earns money just by sitting there! Have students complete budgeting activities like looking up current interest rates and then calculating the potential interest from using those accounts for short and long periods of time. Explore local bank offerings, and take into account things like fees too.

Finance 101

This can also open up great money conversations to have with your child (here’s how to talk to your kids about money, in case you wanted some help with that). Remember, budgeting is a process and not a one-time event or activity. SO, sending a note home to parents about WHAT you’ll be teaching their child, and WHEN this will take place can be really helpful.

Unit 10: Unit Plan & Assessments

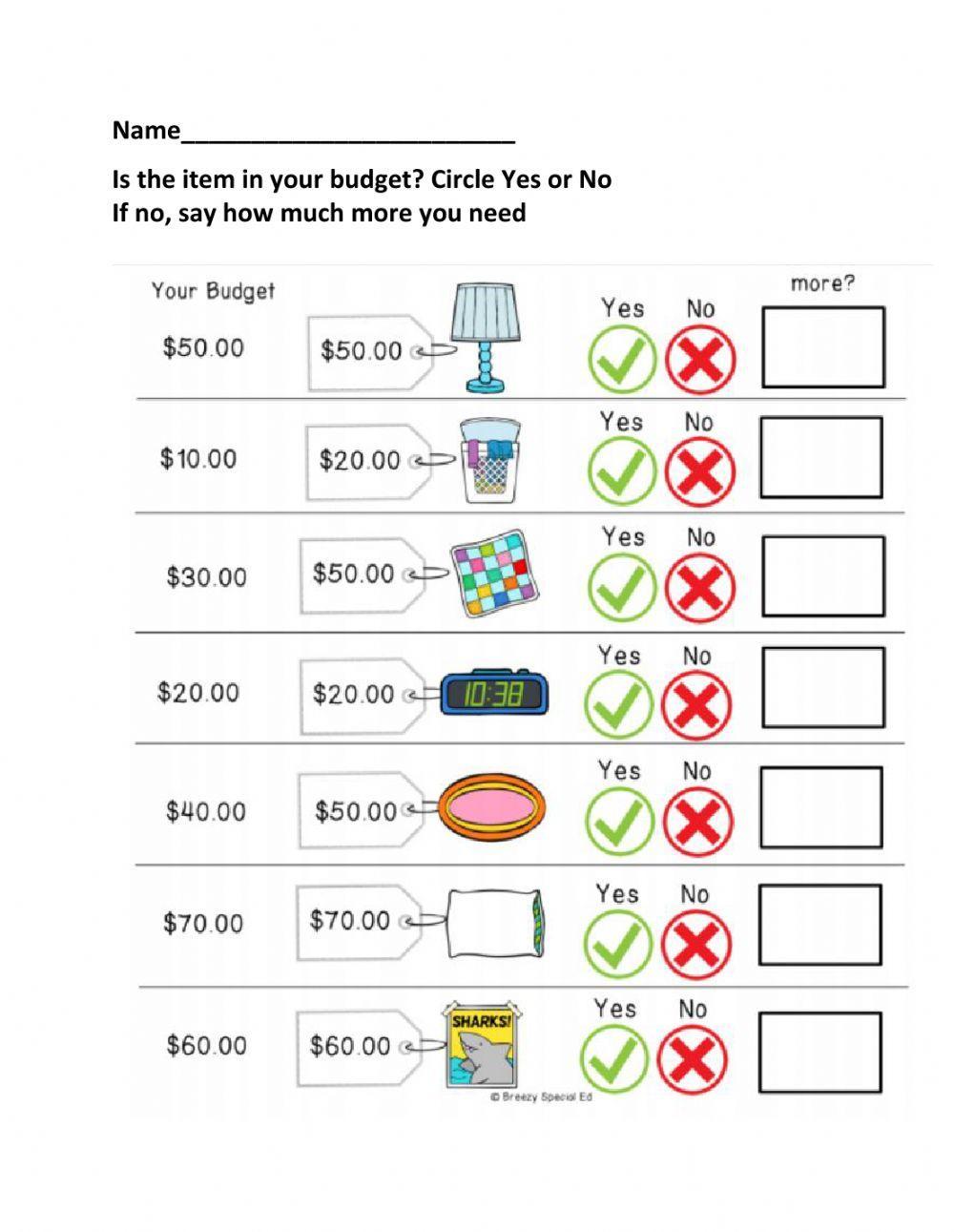

Try this one as a group activity so kids have to work together to make smart choices. Ask students to reflect on what they truly need to survive vs. things that just make life easier or more fun. Budgeting activities like this can help them identify items they can eliminate when funds get really tight. Expose students to a variety of models, like proportional budgets, the “pay yourself first” model, the envelope budget, and more. Ask them to think about which kind of person each model works best for and which one they’d choose. This activity encourages kids to think about purchases, especially major ones.

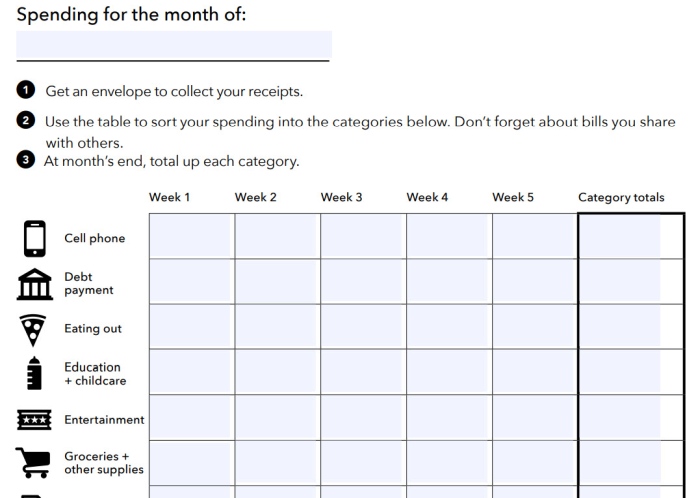

This worksheet should include what I like to call an “Opportunity Cost Parking Lot” area. It’s where your students can “park” spending wants that they’d LOVE to spend their money on…but that don’t take priority over need-based spending (or other spending they want to do, more). There are now spaces for students to both account for specific items they want to spend money on, AND, to do an overall category total for spending. For starters, they’ll begin to work on budgeting in terms of categories, and not just one-use ways to spend their money.

Checking Account Balance Activity (PDF)

You have a set budget for the trip and you make decisions along the trip. All your purchases need to fit within your budget or you won’t have enough money to make it to Colorado. This game can be applied to any “destination” in life and is useful to teach how to stick to a budget even if that means sacrificing a little. After hours of research, I’ve curated a list of free printable money management worksheets (available in PDF format, so you can easily print them out), that, in my opinion, are the best available. Group students together in sizes of 2-4, and hand them 20 jelly beans in total (tell them not to eat them!).

- This game encourages individuals to think about the connections between food access and financial health as well as how good financial habits enhance wellbeing.

- What makes this one different from The Bean Game Activity – aside from the cute printables – are the life issues and circumstances being thrown at teen teams who are playing it.

- This budgeting worksheet for students (pdf) was originally part of my Money Prodigy Online Summer Camp, but I’m carving it out for you to use, for free.

- Have students complete budgeting activities like looking up current interest rates and then calculating the potential interest from using those accounts for short and long periods of time.

There’s also a long list of other free printables on this site, such as home organizing and grocery/menu planning printables. They also need to know their expenses, specifically if you’ve handed them over any money responsibilities (or things they need to pay for). Try out Queen of Free’s Christmas Gift Budget Template — could be a great way to introduce the idea of budgeting to your child. Like, within their “snacks” category, they can choose how to use the total budgeted amount over the course of a week. For example, budgeting for a “clothes” category instead of for “new tee-shirt”, or “hair scrunchie”.

One of the most important money management skills for kids to learn? Kids learning how to budget need to get in the habit of writing everything out. Then, they can see patterns, get up-close-and-personal with the reality of what they earn versus what they want to buy, and make better financial decisions.

In other words, it shows them how much they would have to work and how much they would need to earn in order to afford the lifestyle choices they’ve just made. This game uses national averages for salary and costs to help students determine how much their “dream” adult life will cost…and if they can actually afford it. For example, when I played, I was a bicycle repairer with an annual income of $26,990 (monthly take-home pay of $1,174). Students are randomly assigned a career and salary, and must then create their own spending plan around the money they have.

These games allow adult learners the opportunity to practice money management skills in an enjoyable and cooperative fashion. Budgeting is a critical skill in personal finance, and the more practice your students get in making a budget, the better. Teachers what is operating income operating income formula and ebitda vs operating income and homeschoolers will encounter a variety of resources to teach this concept, but worksheets are a proven way to give your kids hands-on, practical experience. You can find the materials you need to teach budgeting, regardless of your students’ levels.

We all have a dream life that we picture when we “have made it”. This game asks a series of questions about that dream life and then you can see reality and find out what income level you need to support your dream life. This is really beneficial as most dreams are only dreams and don’t have numbers behind them to make them a reality someday. This can help players determine their career pathways for wise financial decisions.