In this case, your kid, tween, and teen get a $100,000,000 production budget to produce a five-star rated movie. Players get to decide how they will spend their budget, though there are required categories (such as food and rent) that they have to spend some in. For example, one month you might find out that someone in your family broke their leg. If you used part of your salary to pay for insurance that month, then you’re good to go. The winner of the game is the person who ends with $450 or more in savings, AND, a social well-being score of at least 96.

Shark Tank Lesson Plans

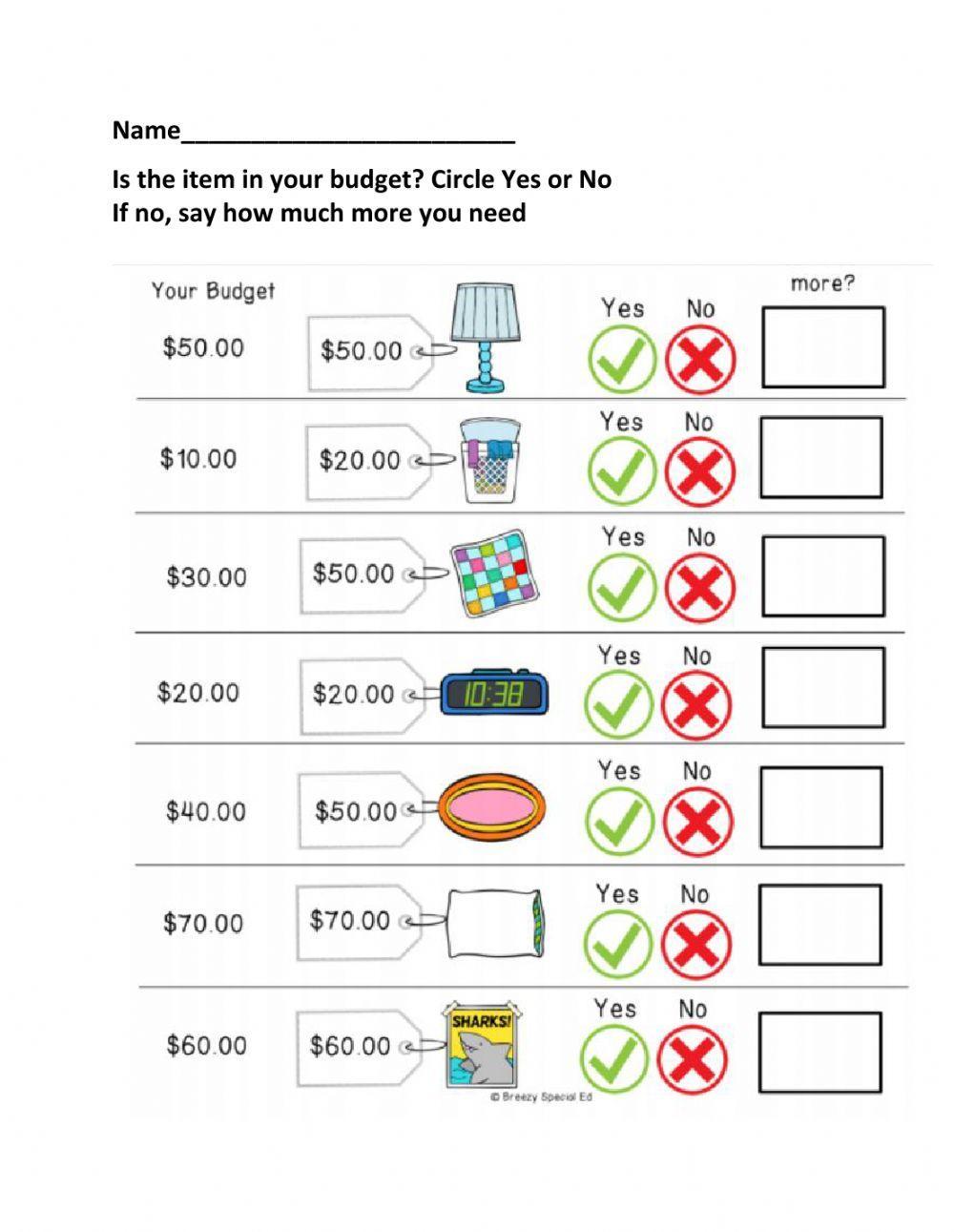

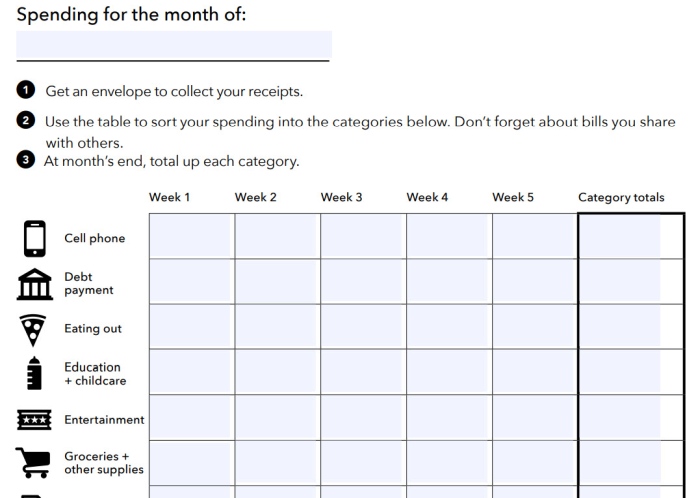

It’s like having a personal money coach in your back pocket. You’re in luck — I’ve created a free set of money envelopes for kids, and you can snag them, here. No matter what level of budgeting you’re teaching, there are a few steps that will help. Not only will they calculate their planned spending vs. actual spending, but they’ll also get practice calculating budgeting percentages to see how they’re lining up with their priorities.

Build a savings “first-aid kit”

- I chose these printable budget worksheet links for a variety of reasons.

- This game can be applied to any “destination” in life and is useful to teach how to stick to a budget even if that means sacrificing a little.

- Ultra Mobile is a prepaid cell phone carrier owned by T-Mobile.

- Budget worksheets can help you create a plan to get to financial independence or retire early.

- With this budgeting scenario, students are asked to look at the finances and situation of Trish and Scott who want to move from Annapolis, MD to somewhere else for a job offer.

- They play the game as a loan shark and the scoring system is based on real life.

Here are budgeting lessons, worksheets, activities and games, and some key tips – by grade. We also include budgeting learning objectives for each grade, which are pulled straight from the National Standards for Personal Finance Education. The Consumer Financial Protection Bureau has developed lots of tools to help teens and adults learn to manage money.

Lesson 7: Build Your Budget

Because what it focuses on is asking students whether or not they do certain money management habits/behaviors, and they have to forfeit a pretend dollar bill each time they answer “no”. Your students are tasked with writing a creative savings comic strip, all around different characters working through an important lesson about saving money. Below are PDFs, games with PDFs, PowerPoint slides, and teacher guides to help you teach your students all about managing money.

Students are given the chance to budget for a girl named Gabrielle. Along with basic budgeting categories, this printable will help you manage short and long-term savings goals, as well as debt payoff goals. Seven years after I started using my first printable budget worksheet system, I’m well on my way to financial freedom. In fact, I still use the same printable budget worksheets today that I used back then.

However, just like in real life, you can’t just spend all your income on paying down debt. You must budget both for real-life monthly expenses, as well as for paying down that debt. Fun budgeting activities (PDFs you can print) will not only begin teaching your students and kids how to budget for specific events OR for life, in general, but it will make the process entertaining. Peter Brown is a National Board Certified teacher with over two decades of experience in the classroom. He loves working with students of all ages in many subjects, but particularly in practical areas like money education, to help kids achieve their goals. When he is not teaching or writing about financial literacy, you can find him surfing, hiking, skiing, or traveling to new places.

And here’s ideas for charities kids can donate to (their “share” category in this printable) where $12 or less makes a big difference. Kids can use these to budget for a specific category of account management software and account management tools spending, like clothes, and can track how much they’ve spent and what they have left on the outside of the envelope. They’re also great to use for when they go to make a store transaction.

A successful budget planner helps you decide how to best spend your money while avoiding or reducing debt. With this budgeting scenario, students are asked to look at the finances and situation of Trish and Scott who want to move from Annapolis, MD to somewhere else for a job offer. Here’s an interesting budgeting game for students to play, that will also increase their awareness of how hard it can be to survive without a job. This game is based on actual Uber driver experiences and can be a real eye-opener. Sometimes they use debit cards, but often they’re credit cards.