This also enables them to substitute future assets with an adequate amount of revenue. In some scenarios, subsequent journal entries may change due to adjustments to the fixed asset’s useful life or value to the company as a result of improvements or impairments of the asset. For example, during year 5 the company may realize the asset will only be useful for 8 years instead of the originally estimated 10 years. The prior depreciation expense cannot be changed as it was already reported.

What is the Straight Line Depreciation Formula?

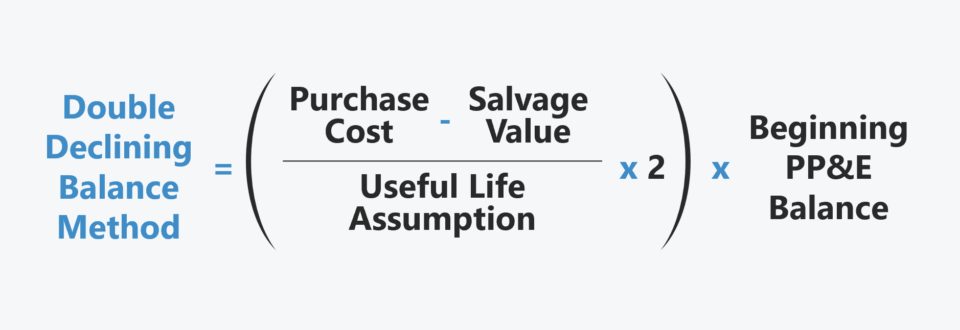

The most important difference between this formula and other common depreciation formulas is the denominator. Other methods have a denominator of 1 or 1/2 depending on whether an asset was acquired during its first year or after it had been in use for 1 year. The denominator in straight-line depreciation is 1/ Estimated Useful Life, which has the effect of making 1/ Estimated Useful Life much larger than 1 or 1/2 when an asset is new.

Example of Straight Line Basis

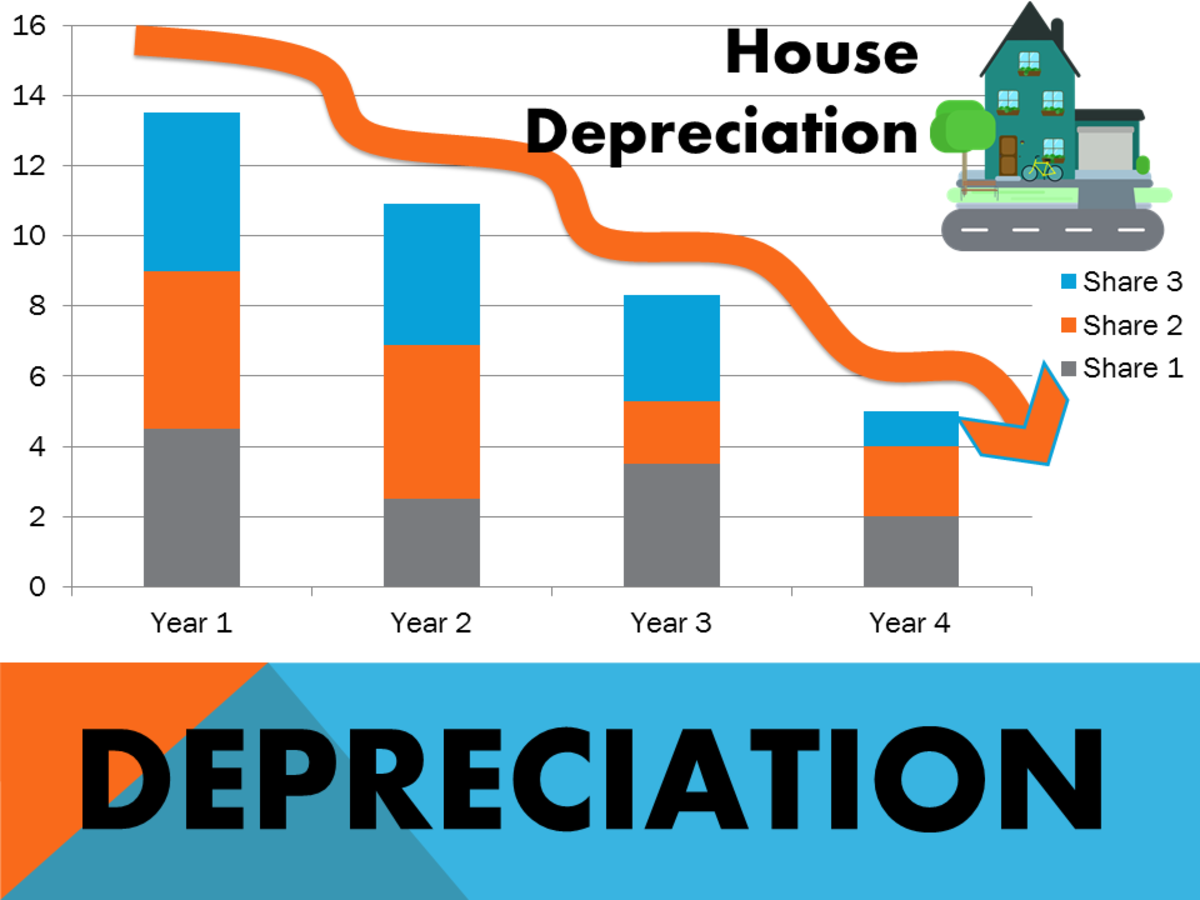

If we plot the depreciation expense under the straight-line method against time, we will get a straight line. Depending on the frequency of depreciation calculation, the carrying amount of the asset declines in equal steps. In accounting, the straight-line depreciation 11 tips for making your charitable donation count on your taxes is recorded as a credit to the accumulated depreciation account and as a debit for depreciating the expense account. Depreciation refers to the method of accounting which allocates a tangible asset’s cost over its useful life or life expectancy.

Advantages and Disadvantages of Straight Line Basis

You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided. Let’s consider a fictional business called “Tech Innovators Inc.” that recently purchased a state-of-the-art computer server for $20,000. The company estimates that the server will have a useful life of 5 years and a salvage value (the estimated value at the end of its useful life) of $2,000.

How is straight line depreciation calculated for a fixed asset?

Therefore, we may safely say that the straight-line depreciation method helps in the process of accounting in more ways than one. To illustrate this, we assume a company to have purchased equipment on January 1, 2014, for $15,000. Here, the company does not estimate a salvage value for the equipment.

Fixed Asset Accounting Explained with Examples, Journal Entries, and More

This reflects the asset’s gradual decrease in value and its impact on the company’s financial health. Salvage value, the estimated residual value of an asset at the end of its useful life, plays a crucial role in straight-line depreciation calculations. It helps determine the total amount that will be depreciated over the asset’s life, impacting both the annual depreciation expense and the asset’s net book value. Businesses can recoup the cost of an asset at the time it was purchased by calculating depreciation. The process enables businesses to recover the cumulative cost of an asset over its life rather than just the purchase price.

- Doing asset depreciation manually, even for seasoned professionals, is prone to error.

- It can be hard for small business owners to know which depreciation method is best and how to record it in their accounting system.

- So remember, we’ve got our 3 variables, cost, useful life, and residual value.

- The straight-line basis is the simplest way to determine the loss of value of an asset over time.

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Increase your desired income on your desired schedule by using Taxfyle’s platform to pick up tax filing, consultation, and bookkeeping jobs. Get $30 off your tax filing job today and access an affordable, licensed Tax Professional.

Also, depreciating an asset does not indicate its market value, only book value, which is calculated based on historical cost minus accumulated depreciation. You can use the straight-line depreciation method to keep an eye on the value of your fixed assets and predict your expenses for the next month, quarter, or year. By estimating depreciation, companies can spread the cost of an asset over several years. The straight-line depreciation method is a simple and reliable way small business owners can calculate depreciation. An accountant uses depreciation is to allocate the cost of a fixed asset over the years of its useful life. The straight-line depreciation method is the most popular type because it allocates the same amount of depreciation to each year the asset is in use.